Group Benefits

We will conduct a comprehensive audit of your current plan, while offering advice on ways to add value to your benefits.

We understand that navigating Group Benefits can be confusing, and that most companies do not have a dedicated Employee Benefits team on staff.

With many years in the benefits industry, and dedicated to simplifying your job, we will conduct a comprehensive audit of your current plan, while offering advice on ways to add value to your benefits.

Whether you are looking to help your employees with their day to day medical and dental costs, provide a Health Care Spending Account, or want to provide a tailored executive benefits program, good advice from one of our qualified advisors is the winning ingredient to a successful long term employee benefits program. Our extensive experience allows us to provide you with the most innovative solutions for your group benefits needs in order to attract and retain long term employees.

Our Services

- Group Benefits for companies of all sizes

- Group Retirement and Pension Plans

- Plan analysis, design and implementation

- Market-wide Brokerage of Benefit Plans

- Analysis of insurance carriers

- Employee Benefit Administration Systems review and placement

- Employee Communications and staff seminars

- Comparisons using our in house Self Insured platform vs fully insured plans to ensure the most cost effective solutions.

- In-House Administrative Services Only (ASO) plans

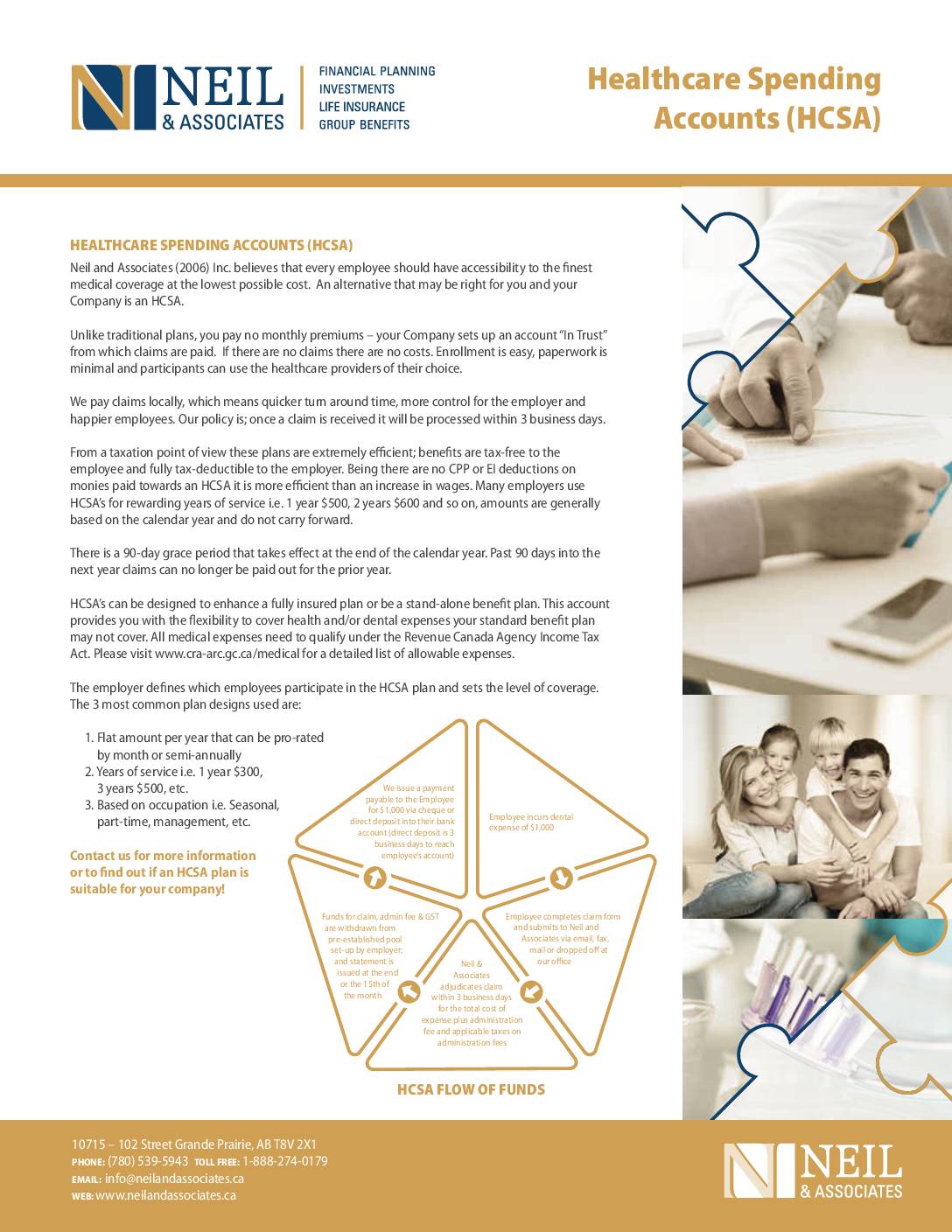

- In-House Healthcare Spending Accounts (HCSA)

- In-house Cost Plus Programs