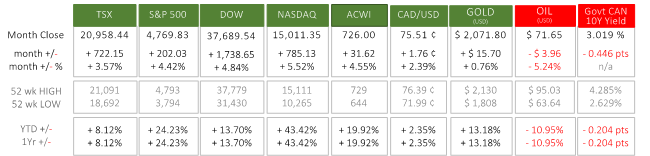

Last Month in the Markets: December 1st – 29th, 2023

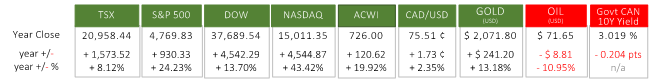

Last Year in the Markets: January 3rd -December 29th, 2023

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in 2023?

The grids (above) for last month and last year share the same colour-coding. The performance of the equity indexes, currency, commodities, and bonds performed in December as they had all year. December’s performance further contributed to the overall trends for the year, as each of the equity indexes had a strong final month of 2023.

The U.S. equity indexes delivered strong returns, especially the NASDAQ which soared by 43% in the past twelve months. The S&P 500 rose 24% and the Dow gained only 13½%. The laggard for the major North American equity indexes was Canada’s TSX, and still delivered a respectable 8% for the year.

The Canadian dollar added nearly 2½% (1.73 cents) compared to its American counterpart, which when combined with the 8% earned by the TSX makes holders of domestic equities and funds closer to the results south of our border.

Oil dropped 11% last year, including more than 5% in December alone. The fall in the price of gasoline, which is directly linked to the price of crude oil, has contributed to falling inflation around the globe.

Slightly more than half of the rise in 2023 for the price of gold occurred after October 7th. The move toward safe-haven investments after the start of the war between Hamas and Israel has entered its fourth month.

Government bond yields fell by the end of the year after reaching peaks in the weeks immediately following the conflict in Gaza. After many years of low returns, the increase in interest rates from central banks to combat inflation made these investments more attractive from a performance perspective.

Many developments contributed to the overall results of 2023 for many different asset classes. Internationally, geopolitical events and tensions between the U.S. and China, Russia’s continued invasion of Ukraine, and the war in Gaza were influential. The actions of governments and central banks to combat inflation affected employment, economic growth, and stock prices.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

Many events contributed to the up-and-up-and-up year for equity investors:

- January’s month-long rise with a mid-month stumble

- January 7th – The year began with the U.S. House of Representatives unable to elect a Republican Speaker of the House. Eventually, after 15 votes Kevin McCarthy prevailed, and then speculation that he had ceded too much power to achieve his position began. Debate regarding the Republican’s ability to move the economy forward by cutting taxes also commenced as McCarthy’s tenuous leadership started. CNN and McCarthy

- January 19th – Equities faltered as the U.S. debt ceiling reached its limit. The Department of the Treasury began utilizing extraordinary measures to keep the federal government operating for about five months.

- January 30th – The two last days of the month were negatively affected by the upcoming Federal Reserve interest rate announcement on February 1st. Markets wavered between accepting economic “good news” at face-value or interpreting “good news” as fuel that could propel additional interest rate increases by the Fed. CNBC and rates

- Mid-March gully delays gains

- March 10th and 12th – Much attention has been paid to the effect on consumers from rising interest rates, but financial institutions were also exposed. As short-term rates rise, and banks must pay current, market rates on deposits. Their existing long-term investments at lower rates of return deliver income to the banks at lower levels and cause a narrowing of margins. A confidence-crisis and bank-run resulted, and regulators in California to shut down Silicon Valley Bank on March 10th. This led to additional scrutiny and wider worries for bank solvency and was amplified when the FDIC shuttered Signature Bank on March 12th. The confidence crisis in banking triggered a decline for equity indexes. SVB Fallout Spreads. Equity markets began a tentative recovery after the U.S. Treasury Department, Federal Reserve and Federal Deposit Insurance Corporation added increased protections for depositors and introduced a new borrowing facility to allow banks to meet short-term cash needs. Joint release

-

- March 19th – The effects of increasing interest rates were not limited to the United States when Credit Suisse was exposed and was rescued by UBS under very generous conditions. The reputation of Swiss bank security and discretion could be damaged further as Switzerland’s Attorney General has launched a criminal investigation into the takeover. Swiss investigation CS/UBS

- Late April dip then a protracted climb into summer

- April 12th – The U.S. Bureau of Labor Statistics released consumer inflation data for March. Prices had risen 0.1%, while the year-over-year rate was measured at 5.0%. The annualized rate remains stubbornly above the Federal Reserve’s target of 2% annual price increases. Markets worried that heightened inflation would lead to additional monetary policy moves to slow demand, including more interest rate rises. BLS release

About two hours later, the Bank of Canada (BoC) released its interest rate announcement. For the second consecutive time, the Bank did not change its policy interest rate, holding the target for the overnight rate at 4½%. Bloomberg and Fed rate increases BoC release

-

- April 25th did not start well for equities as all indexes dropped close to 1% in the first hour of trading, but by the end of the month those short-term losses had been reversed as strong economic news emerged. Gross Domestic Product (GDP) and Personal Consumption Expenditures (PCE) price index data were the main drivers. GDP grew at a rate of 2.6% in the final quarter of 2022, and the 2.1% for all of 2022. PCE, which is the Federal Reserve’s preferred indicator for inflation rose 4.2% in March, down from February’s 5.1%. The result of these two items was a strong uptick for equities. It appears that the economy is slowing, and inflation is softening, which reduced pressure on the Federal Reserve to continue raising interest rates. CNBC GDP & PCE BEA PCE release

- May 3rd –S. Federal Reserve increased its federal funds rate by 25 basis points. Predictions that the Fed would not raise rates were proved wrong, but the meeting minutes of the Federal Open Market Committee indicated that the decision was not unanimous. Equities dipped temporarily on recession fears. Fed press conference

- May 5th – Equites recovered quickly from the Fed’s rate increase when Canadian and U.S. jobs data was released. Employment rose by 41,000 and 253,000 in April respectively, and unemployment remained unchanged in both countries at 5.0% and 3.4%. The strength of the jobs market showed that a recession was not immediately on the horizon. StatsCan Labour Force Survey BLS employment

- Climb continued through June and into July

- June 2nd – The U.S. jobs market continued its strong growth when nonfarm payroll increased by 339,000 in May, which is more than March and April’s employment increases of 217,000 and 294,000, respectively.

- June 9th – Canadian “overall employment was little changed in May, as employment fell by 77,000 for youth aged 15 to 24 and it increased by 63,000 among people aged 25 to 64” according to May’s Labour Force Survey.

- June 13th – The Bureau of Labor Statistics released S. inflation data for May showing consumer price increases of 0.1% in May and year-over-year of 4.0%. Prices had risen 0.4% in April, and May’s annualized inflation rate was the lowest since March 2021.

- June 14th – The Federal Reserve delivered an interest rate decision, holding rates steady, and markets reacted mostly favourably. The pause in interest rate increases is expected to be temporary according the information released with the announcement since the 2% inflation target has not been reached. Simultaneous to the interest rate announcement was the release of the Fed’s Summary of Economic Projections, which contains the dot-plot, which collects the individual opinions of Federal Open Market Committee (FOMC) members for upcoming interest rates. FOMC members had projected that interest rates will rise into 2024 before falling slightly, and lower rates in the 3 to 3½% range will arrive in 2025.

- June 30th – The Bureau of Economic Analysis reported the Personal Consumption and Expenditures price index rose by 0.1% in May after rising 0.4% in April. The PCE is the Federal Reserve’s primary inflation indicator, and raising rates high enough to slow spending, but maintain modest growth is the goal.

- Mid-July Peak

- July 7th – Continued strength in employment for June held markets steady. The increase of 60,000 and 209,000 additional jobs in Canada and the U.S., respectively, represented a situation where “good news” might actually be “bad news”. A robust labour market that is able to fuel consumer demand and inflation might require more severe monetary policy from the Bank of Canada and the Federal Reserve. Markets were wary, and held their ground, and did not rise on this news that might otherwise be interpreted positively. StatsCan Employment data BLS Jobs

- July 12th – The U.S. Bureau of Labor Statistics reported that the CPI had risen 0.2% in June, and the all-items index had risen 3.0% over the last 12 months. BLS inflation

The Bank of Canada increased its benchmark interest rate by ¼ percent (25 basis points) to 5%. “However, robust demand and tight labour markets are causing persistent inflationary pressures in services” according to the Bank’s press release and in its Monetary Policy Report. The lowering inflation and tempered policy by the Bank of Canada were viewed positively and markets turned upward in response.

-

- June 18th – StatsCan announced annualized inflation at 2.8%, which was down from the previous month’s annual inflation of 3.4%. StatsCan CPI data

- July 26th – The Federal Reserve increased its interest rates, again by 25 basis points (¼ percent). Some had hoped for a pause in rate increases as inflation slowed, but once the news was digested, markets rose again. Fed Press Conf

- July 28th – The Fed’s primary inflation indicator, the Personal Consumption Expenditures price index showed an increase of 3.0% over the past year and 0.2% for June, which is a very positive indication of economic results. PCE Release

- August dips on ratings downgrade and China’s woes

- August 1st – Fitch Ratings downgraded the quality of U.S. sovereign debt from “AAA” to “AA+” reflecting “the expected fiscal deterioration over the next three years, a high and growing general government (GG) debt burden, and the erosion of governance relative to . . . peers . . . that has manifested in repeated debt limit standoffs and last-minute resolutions.” The government debt issue is driven by weaker federal government revenue, new spending initiatives and higher interest rates as the general government deficit is predicted to rise to 6.9% of Gross Domestic Product in 2025. CBC and Fitch Press Release from Fitch

- August 4th – U.S. Employment situation summary and the Canadian Labour Force Survey were both released. Markets treated this data with wariness since the American job market continued its resiliency concern that interest rates would remain at current levels grew. In the U.S., non-farm payroll employment rose by 187,000 jobs in July. Employment in Canada was static in July with 6,000 less jobs, which represents a change of less than one-tenth of one percent. StatsCan July Jobs BLS Jobs NYTimes Jobs

- August 14th – Economic indicators from China, the world’s second largest economy with significant international trade, began to turn downward. China’s economic recovery and growth are slowing. The economic integration by Canada and the U.S. differs in magnitude and by overall trade balance, and “bad news from China” has affected different stocks and sectors differently in North America. Canada’s closer ties caused a steeper decline than American indexes, but overall, both sides of the border have been impacted to the magnitude. China Trading Partners China’s economic woes

- Early October Climb

- September 30th and October 1st – Just as the month was beginning a stop-gap measure that extends spending for an additional 45 days was found to avoid a U.S. government shutdown. CNBC and “shutdown” CNN and “shutdown”

- October 6th – “Total nonfarm payroll employment rose by 336,000 in September, and the unemployment rate was unchanged at 3.8 percent”, according to the U.S. Bureau of Labor Statistics. BLS Jobs

- October 11th and 12th – On two consecutive days U.S. producer and consumer inflation data was released. The Producer Price Index (PPI) increased 0.5% in September, down slightly from 0.7% in August. Year-over-year prices advanced 2.2%, which is the largest increase since April. Consumer prices rose 0.4% in September, down from 0.6% in August. Over the last 12 months the Consumer Price Index (CPI) has risen 3.7%, which is the same reading as in August BLS PPI release BLS CPI release

- October 17th – Canada’s CPI was lower than expected. On a year-over-year basis consumer prices rose 3.8% in September, slightly lower than the 4.0% gain measured in August. CBC and CPI StatsCan CPI release

- October 25th – The Bank of Canada made a monetary policy announcement that kept the policy interest rate unchanged. According to the press release, “Inflation has been easing in most economies, as supply bottlenecks resolve, and weaker demand relieves price pressures. However, with underlying inflation persisting, central banks continue to be vigilant.” This may provide insight into the Federal Reserve’s next announcement. BoC Press Release CBC and BoC

- October 26th – S. GDP grew faster than expected during the third quarter. The annualized pace is 4.9%. The expanding economy, and inflation above goal, may provide rationale for the Federal Reserve to tighten monetary policy by raising interest rates, but traders saw that as unlikely. CNBC and GDP BEA release

- October 27th – In September, the PCE price index rose 0.4%. Core PCE (excluding volatile food and energy) increased 3.7% on a year-over-year basis. BEA and PCE CNBC and PCE

- Early November dip before more gains

- November 1st – The U.S. Federal Reserve held the federal funds rate changed. No promises of rate reductions were offered. Fed release CNBC equities and Fed

- November 3rd – The Canadian economy added 18,000 jobs last month, after adding 64,000 jobs in September and 40,000 in August. October’s performance represents a slowing of the Canadian economy. The unemployment rate rose to 5.7%, the fourth consecutive monthly increase. StatsCan release

The Bureau of Labor Statistics reported that nonfarm payroll had risen by 150,000 in October, and the unemployment rate rose 0.1% to 3.9%. BLS release

-

- November 9th – Federal Reserve Chair, Jerome Powell, stated at an International Monetary Fund meeting that interest rates may not be high enough, yet, to bring inflation back to the 2% target, again demonstrating the sensitivity of markets to interest rate speculation. AP and Powell

- November 14th – The U.S. annualized Consumer Price Index increased 3.2%, down from September’s year-over-year inflation rate of 3.7%. The Federal Reserve’s pause on interest rate increases appears to be well reasoned at this time. S. equity indexes rose 1½ to 2½ and the TSX jumped 1.6% for the day. BLS CPI CNBC and CPI More CNBC and CPI

- November 15th – After the U.S. House of Representatives passed another spending bill the day before, the Senate voted 87-11 to end the third and latest fiscal standoff ahead of a deadline. CNN and US Govt

- November 21st – The Canadian Consumer Price Index (CPI), rose 3.1% on a year-over-year basis for October, down from 3.8% in September. Gasoline prices fell by 7.8% in October and was the primary driver of lower overall inflation. StatsCan CPI release

- November 30th – Canadian GDP dropped 0.3% in the third quarter after rising by the same amount in the second quarter. Less exports, slower inventory accumulation, and greater household savings contributed to the decline. StatsCan GDP release

The Bureau of Economic Analysis released its Personal Consumption and Expenditures (PCE) price index had risen 0.1% in October, and 3% from a year ago. CNBC and PCE BEA PCE release NYTimes and PCE

- End of Year Positivity

- December 19th – Canada’s Consumer Price Index (CPI) rose 3.1% on a year-over-year basis in November, which matched October’s increase. Excluding food and fuel the CPI rose 3.5%, up slightly from 3.4% for the same measure in October. StatsCan inflation release

The European Union reported that their Harmonised Index of Consumer Prices (HICP) was 3.1%. A year earlier, the annual inflation rate was 10.1%. EU HICP release

-

- December 22nd – The PCE price index fell 0.1% in November and rose 2.6% on a year-over-year basis according to the Bureau of Economic Analysis. BEA PCE release

- The next round of interest rate and monetary policy announcements will not begin until January 24th and 31st for the Bank of Canada and Federal Reserve, respectively. The Governing Council of the European Central Bank meets next on January 25th, and the Bank of England has scheduled its next release of Monetary Policy Committee actions on February 1st.