Monthly Market Update for January 2025

Last Month in the Markets: January 2nd – 31st, 2025

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in January?

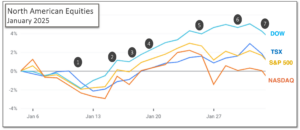

Equity performance for the first month of 2025 was strong. All of the indexes in the grid, above, outperformed their one-year returns in January, except for the NASDAQ. Even as the laggard, the NASDAQ will clear 20% in 2025 if it continues its January pace.

The month included the inauguration of the 47th U.S. President, interest rate announcements, inflation and Gross Domestic Product data.

The most significant action affecting investors will be the threatened tariffs that were introduced on February 1st by Donald Trump. The effects of tariffs will be felt in future periods.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

In January, the events and announcements included:

- January 10th

StatsCan’s Labour Force Survey reported that Canadian employment rose by 91,000 in December. The unemployment rate declined slightly by 0.1 percentage points to 6.7%. The increase to was almost four times the amount anticipated by analysts and economists. StatsCan release CBC and LFS

U.S. employment increased by 256,000 in December, which was 38% above the 2024 monthly average of 186,000. The unemployment rate remained constant at 4.1%, and the number of unemployed people did not change in December and sits at 6.9 million. BLS release

- January 15th

Consumer prices rose 0.4 percent in December, and the all-items index increased by 2.9 percent over the last year according to the U.S. Bureau of Labor Statistics. Over 40 percent of the month’s increase is attributed to energy prices. Gasoline rose 4.4 percent in December. The annual rate for Core CPI, which excludes more volatile food and energy, was 3.2 percent and slightly better than expectations of 3.3 percent. BLS CPI release CNBC and December 2024 CPI

- January 17th

Although only 9% of S&P 500 companies have reported, earnings, earnings per share and revenue growth are above 10-year averages. If the results continue, it will be the seventeenth consecutive quarter with revenue growth. The Financials sector was the largest contributor to the overall earnings growth rate. FactSet release

China’s economy expanded by 5.4% in the in fourth quarter, exceeding expectations. The full year GDP reached 5% as stimulus measures delivered results aligned with overall goals. Future GDP growth may be hampered by tariffs imposed by President Trump, and the effects would likely be felt after the first quarter and beginning in the second half of the year. CNBC and China GDP

- January 20th

Donald Trump was inaugurated as the 47th President of the United States in a ceremony on the Rotunda of the Capital Building. Within the first days of his presidency over one hundred executive orders were signed to further his agenda. The Republican party controls the Executive and Legislative branches of government, and the conservative Supreme Court provides a strong mandate enabled by limited resistance.

- January 24th

As of his first Friday after returning to office, Trump’s threatened tariffs had not materialized. A February 1 implementation date for 25% tariffs against Canada and Mexico imports has been repeatedly mentioned. In some statements tariffs are designed to facilitate the tightening of borders that permit drugs and illegal immigrants to enter the U.S.

President Trump has suggested that firms could relocate production to the U.S. to avoid paying tariffs, and that tariffs would generate revenue for the U.S. government. CNN and tariffs CBC and tariffs The Guardian and tariffs Global and threats

Fourth quarter earnings for U.S. corporates continued their positive results. After about 80 firms of the S&P 500 have reported, seven of the eleven sectors are reporting year-over-year earnings growth for Q4, and six of the seven are reporting double-digit growth. FactSet Insights 250124

- January 29th

The Bank of Canada lowered its policy interest rate by 25 basis points, the U.S. Federal Reserve held rates steady and the European Central Bank took the same decision as Canada. Progress against inflation was the main justification for continuing to reduce rates, along with the desire to stimulate economic activity. Tariffs have the capability of sparking inflation and reducing economic output, which will likely induce additional monetary policy changes.

- January 31st

The U.S. Bureau of Economic Analysis released the Personal Consumption and Expenditures (PCE) price index, the Federal Reserve’s preferred inflation indicator. On a monthly basis headline PCE rose 0.3% and 2.6% on a year-over-year basis for December. Both figures were aligned with expectations and are above the Fed’s targets. CNBC and PCE BEA release

What’s ahead for February and beyond?

On Saturday, February 1st, President Trump signed an executive order that imposed tariffs of 25% on imports from Mexico and Canada. China and Canadian energy will be subject to a 10% import tariff.

This order is in violation of the United States-Mexico-Canada Agreement, which was signed into law by Donald Trump in 2020 during his first presidency. The near universally held opinion at the time was that open trade between the three countries through the modernization of the North American Free Trade Agreement (NAFTA) was positive for each national partner. USMCA explainer

On the morning of February 3rd, a one-month pause was negotiated by Mexico after committing to deploy troops along its norther border to slow illegal immigration and drug shipments.

The specifics of China’s response, other than a challenge at the World Trade Organization (WTO), has not been communicated.

Canada introduced a retaliatory schedule of 25% tariffs on American imports. After two telephone calls between Trudeau and Trump on the eve of bilateral tariffs, a postponement for 30 days was agreed. Prime Minister Trudeau will implement a $1.3 Billion border security plan, appoint a fentanyl “czar” and designate Mexican drug cartels as terrorist organizations. Approximately 10,000 additional personnel will be deployed to the border. However, less than 20 kg of fentanyl were seized entering the U.S. from Canada, while 9,780 kg were seized from Mexico.

During the 30 day pause President Trump may impose additional demands on Canada and Mexico. Investors, governments and businesses have another few weeks to prepare for tariffs or negotiate terms to avoid their implementation. Tariff postponement Trump tariffs Canadian response Chinese response NYT summary

Lastly, for Canadians taxpayers looking to reduce their 2024 taxable income, the deadline for RRSP contributions is March 3rd.