The primary purpose of retirement savings is to generate income. The rate of return earned, and the sequence of these rates of return, when withdrawals are made will determine how long a retiree’s portfolio will last.

The accepted long-term rate of return for income planning is 6 percent. Portfolio performance may average returns of 6 percent but returns of plus-or-minus 25 percent not uncommon. When and the order of those aberrations occur, the outcome can significantly affect a portfolio’s lifespan.

What you need to know

For context, a portfolio with a value of $500,000 earning 6 percent generates annual income of $30,000. Under these conditions a retiree could withdraw $30,000 at the end of each year forever.

Unfortunately, returns of exactly 6 percent have never occurred year-after-year for equity indexes or fixed income investments. It is the average rate used for top-line planning purposes. Returns can fluctuate widely with some years generating 20 to 25 percent gains, and bad years dropping by the same proportion. The last five years are a recent example.

Most importantly, once a loss occurs, it is typically unsuitable for a retiree’s investments to assume enough risk to generate high returns to replenish the portfolio. It is best to manage risk and losses, while generating adequate income to prevent damage to the portfolio.

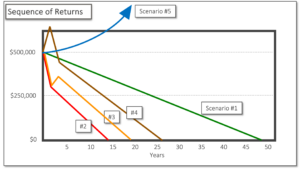

The sequence of returns can dramatically affect a portfolio’s ability to generate the income necessary for retirement living. It is necessary to plan for both good and bad years by balancing expected returns with risk. Sample scenarios determining portfolio longevity:

- Returns at Planned Rate: $500,000 portfolio reduced to $470,000 by initial withdrawal, then generates 6% returns each year; the portfolio will be exhausted after 48 years.

- Deep Losses, then Returns at Planned Rate: $500,000 portfolio subject to year-end withdrawals of $30,000 suffers losses of 25% in year 1 and 20% in year 2, then gains 6% each year; the portfolio will be exhausted in less than 14 years.

- Deep Losses, then Strong Gains, then Returns at Planned Rate: $500,000 portfolio subject to year-end withdrawals of $30,000 suffers loses of 25% in year 1 and 20% in year 2, then earns gains of 25% in year 3 and 20% in year 4, then earns 6% each year; the portfolio will be exhausted in its 20th

- Strong Gains, then Deep Losses, then Returns at Planned Rate: $500,000 portfolio subject to year-end withdrawals of $30,000 earns gains of 25% in year 1 and 20% in year 2, then suffers loses of 25% in year 3 and 20% in year 4, then earns 6% each year; the portfolio will be exhausted in its 26th

- Strong Gains, then Returns at Planned Rate: $500,000 portfolio subject to year-end withdrawals of $30,000 earns gains of 25% in year 1 and 20% in year 2, then earns 6% each year the portfolio will never be exhausted. With the boost during the first two years and more income than withdrawals; the portfolio will be worth over $1 million after 20 years.

The goal of the plan is not to rigorously describe exactly the course of future events. It is to determine the best path, understand the implications of deviations and provide direction to reorient back toward the original goal.

Other considerations, in addition to earning adequate returns to satisfy income demands outlined in a Financial Plan must be accounted for to protect retirement income. They include: the generation of cash-flow to facilitate withdrawals, timing of withdrawals during the year, the frequency of withdrawals, tax planning, coordination with Old Age Security and Canada Pension Plan payments, and legacy and estate planning.

The Bottom Line

Determining a realistic and conservative rate of return for a retirement portfolio is only the initial step. The size of the portfolio and expected rate of return will calculate the anticipated lifespan of the portfolio. Including this lifespan along with other sources of income, asset sales, anticipated taxes and a retiree’s health and family history will facilitate decisions regarding their finances.

The most prudent course of action is to discuss retirement income planning and the sequence of returns with your professional financial advisor to manage risks and your needs.

Sources:

https://www.fpcanada.ca/docs/default-source/standards/2024-pag—english.pdf?sfvrsn=17a26b4c_3